- #THE SHOCKINGLY SIMPLE MATH TO EARLY RETIREMENT PLUS#

- #THE SHOCKINGLY SIMPLE MATH TO EARLY RETIREMENT FREE#

The bulk went to savings with little effort or discipline. I chose my spending consciously based on my values (personal growth, reading, research, outdoor sports, adventure, and recreation), and never needed to spend much of the fat income. I just raised my income to a very high level, paid my house off, and never got frivolous, but never suffered. In fact, I initially built my wealth following this exact formula. Sure, it's far less than you could afford at that income level, but again, it's a choice. It leaves plenty of spending money for lifestyle today. Try running the same numbers with $250K or $300K in income. It's possible if that's your choice.Īlternatively, living on 20-30% of your income doesn't have to equate to extreme frugality. There are people who choose to live in motorhomes, use public transportation or their bicycle, shop only at thrift stores, grow their own food, and so on to keep expenses to a bare minimum. They would sooner live without the luxuries that others have claimed are necessities than pay the price of working to have all that stuff.

There are many people who have committed to extreme frugality as a lifestyle choice because they don't want to spend any more of their life than absolutely necessary working for money. That's only true for the people making those lifestyle choices.

The little voice in your head was saying something like that. The idea of living on 20-30% is a pathetic joke! Your article is complete rubbish!” The first and most obvious comment nearly every reader will have to these two examples is something like, “Cute idea, Todd, but I can't even get by on 100% of my income. This is greater than the $9,600 ($800 per month) you would be living on for this scenario. You could be financially independent in less than 7 years, because $3,200 per month at 8% results in a $361,000 savings balance, providing $10,830 of annual spendable income at 3%. If you're really in a hurry to tell your boss what he can do with your job, and don't mind extreme frugality, then try saving 80%.

#THE SHOCKINGLY SIMPLE MATH TO EARLY RETIREMENT PLUS#

It explains everything in step-by-step detail… plus a whole lot more.) (If that math went by a little too fast and you want more detail, read this book: How Much Money Do I Need To Retire. This would be $1,000 per year greater than what you had been living on. Yes, I know that leaves you with only $14,400 per year to live on (I'll address this issue later), but the fact is, you'll be financially independent in 10 years because 3% of $515K is $15,450 in spendable income. If you saved 70% of your income, or $2,800 per month, at 8% return, you would have $515,000 at the end of 10 years. Learn more about Personal Capital in our review.

#THE SHOCKINGLY SIMPLE MATH TO EARLY RETIREMENT FREE#

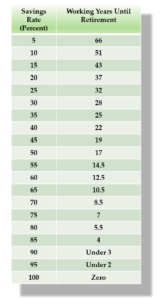

Another invaluable tool is the retirement planner available with a free Personal Capital account when you link your existing investment accounts and enter assumptions about how much you'll spend and save, Personal Capital can show you exactly how soon you'll be able to retire based upon projections of your specific investments. Using one of my handy retirement calculators, we'll determine how long it takes to save your way to financial independence applying industry standard numbers like 8% for investment return, and 3% spendable retirement income to support living expenses. The key is the percentage of income that is dedicated to savings.) (By the way - the actual income level is irrelevant to the calculation, as you will see below, so use whatever income works for you. That works out to $4K per month spendable.

Alternatively, you could just assume $48K after taxes and eliminate the tax complication from the equation. We'll assume $48,000 per year earned income to keep the taxes low and the math easy. Let's play with some simple equations to illustrate the point. Get This Article Sent to Your Inbox as a PDF… Send Me This Article!

0 kommentar(er)

0 kommentar(er)